Welcome to the 6th edition of Shrimpy’s weekly newsletter, a place for staying up to date on the latest trends, news, and events in the cryptocurrency industry.

Digital assets evolve and move faster than any other market. For those who do not have time to constantly scroll Crypto Twitter, we wrote a special weekly update covering everything major that happened last week.

Is there such a thing as an unauditable crypto exchange?

Per the words of Sam Bankman-Fried, the answer is yes.

A new report reveals that Sam had absolutely no oversight or control over trading firm Alameda Research and its balance sheet.

The firm would sometimes lose track of up to $50 million in crypto funds — chump change for the likes of SBF.

It becomes clear as time goes on that SBF & Co were not only malicious but also incompetent.

With so much evidence out there, Sam will surely get the ending he deserves…right?

🤦♂️SBF Considered Alameda ‘Unaduitable’

The new FTX CEO John Ray released a 45-page report on control failures that led to the exchange's collapse, revealing that Sam Bankman-Fried considered Alameda 'unauditable.' The report showcases FTX's accounting failures and cybersecurity lackluster.

Alameda Research was a crypto trading firm operated by Caroline Ellion, one of Fried's close partners. Although Mr. Fried publicly stated that FTX and Alameda were two separate entities, the exchange’s collapse revealed that it wasn't the case.

The latest report confirms that Alameda could withdraw as much crypto from FTX as it wanted. Moreover, the trading firm was barred from liquidations - making Alameda the most privileged market maker (MM) in the history of finance.

“Alameda is unauditable. I don’t mean this in the sense of ‘a major accounting firm will have reservations about auditing it’; I mean this in the sense of ‘we are only able to ballpark what its balances are, let alone something like a comprehensive transaction history.’ We sometimes find $50m of assets lying around that we lost track of; such is life.”

One quote from the report reveals that Fried knew that Alameda was unauditable. He stated there was no way to keep track of the firm's balance sheet, revealing that they'd sometimes find $50m in crypto that they'd "lost track of."

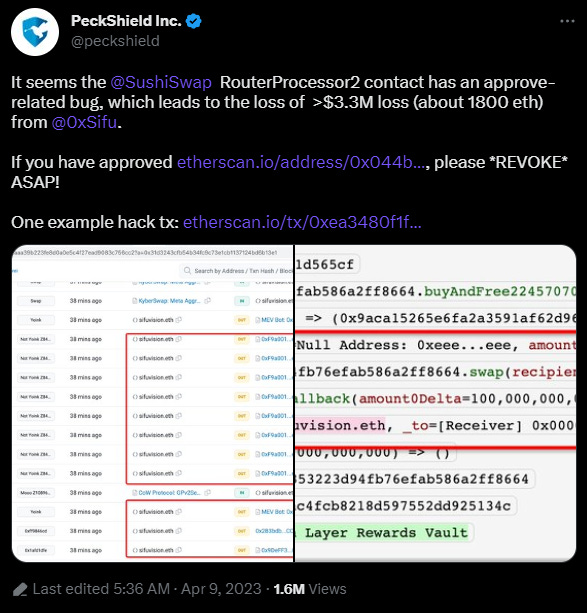

🍣Sushi Loses $3.3M in Smart Contract Exploit

Sushi, a decentralized exchange that launched as a Uniswap clone, suffered a smart contract exploit last week, leading to $3.3 million in losses. The exploit involved a contract called 'RouterProcessor2' that Sushi uses to facilitate trade routing.

It was later found that the exploit only affected users who approved trades on Sushi 4 days prior to the attack.

The Sushi team launched a tool allowing users to check if their wallets were exploitable. They also urged users to revoke permissions for all Sushi contracts. One Twitter thread revealed that several whitehat recoveries are underway and that Sushi will return funds to those impacted.

🌊OpenSea Launches OpenSea Pro

Ethereum's leading NFT exchange announced the launch of OpenSea Pro, a new marketplace with advanced features targetting professional NFT traders. OpenSea likely launched the product as a reaction to Blur's rapid rise.

OpenSea notes that traders have to pay a 2.5% fee on the main platform, while Pro users pay no fees.

OpenSea Pro offers numerous features, including floor sweeping, inventory management, optimized gas fees, and a watchlist. According to CEO Devin Finzer, OpenSea Pro is the most efficient NFT trading tool on the market.

🐕DOGE Pumps 20% After Elon Musk Changes Twitter Logo

Twitter had a makeover last week after CEO Elon Musk replaced the bird app's logo with a picture of Doge. Dogecoin went on to immediately jump 20% in value. However, when Musk returned the old logo, the meme altcoin dropped to its pre-pump price level.

Doge’s initial explosive pump wasn’t followed up with more buyers attempting to crush the $0.1 resistance. As a result, Doge went on to slowly bleed out before finally crashing when Twitter got its old logo back on Friday.

🏦Bank of England to Hire 30-Man Team for ‘Britcoin’

The Bank of England is looking to hire a 30-man team to develop its future CBDC, reports the Sunday Times. The central bank published various open positions, including a 'Digital Pound Security Architect' and a 'Digital Pound Solutions Architect.'

Earlier this year, the BoE invited the public to weigh in on its plans to launch a digital version of the pound sterling. The central bank currently works with the country's finance ministry on the CBDC's research and development.

There is no information as to whether the CBDC, dubbed 'Britcoin' by the press, will utilize blockchain technology. The Bank of England stated that this decision had not been made yet.

🔔Magic Eden Launches BTC Ordinals Launchpad

Multi-chain NFT marketplace Magic Eden has launched a launchpad for Bitcoin ordinals, allowing creators to mint BTC inscriptions and sell them to collectors. The launchpad complements an already launched Bitcoin marketplace by helping users create new NFT collections on the Bitcoin blockchain more easily.

According to co-founder Zhuoxun Yin, the launchpad will grow a larger market for tokenized assets on Bitcoin:

“Bitcoin is the grandfather of all blockchains, and we believe it can be the home to pure digital artifacts…With Ordinals, content can be preserved forever, and we're proud to be helping creators and the Ordinals community grow together."

Magic Eden started the launchpad by partnering with Ethereum NFT collection Godjira and releasing a Bitcoin collection named (Dead)Jira. The marketplace also partnered with other creators such as Genopets, Humanoid, and Lazy Lions.

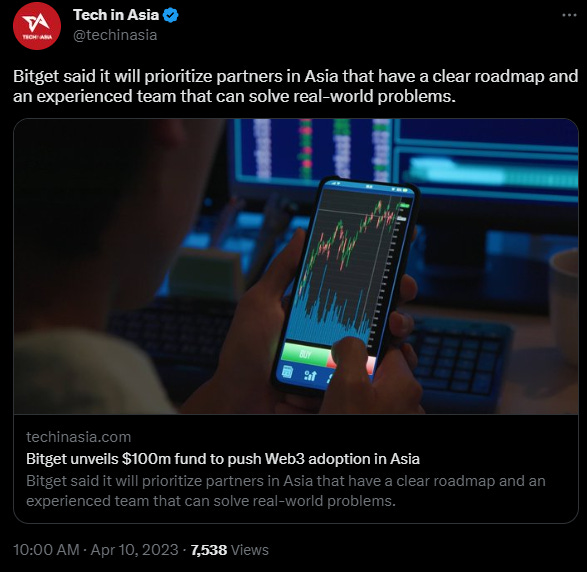

💰Bitget Invests $100m in Web3

Crypto derivatives exchange Bitget launched a Web3 fund for crypto projects in Asia worth $100 million. The fund will provide the initial investment required to jumpstart the next generation of Web3 projects.

Bitget's managing director Gracy Chen noted:

“We can see that Web3 space is evolving rapidly and many projects deserve the support to further advance such development and make Web3 a truly global phenomenon, as Web2 had once become. That is why the Bitget Web3 Fund will strive to seek out projects that have the most impact on this process,”

Several well-known VC investors have joined the initiative and partnered with Bitget, including Dragonfly Capital, DAO Maker, SevenX VEntures, ABCDE Capital, and Foresight Ventures.

💳Lido Finance to Open ETH Withdrawals in May

Ethereum investors who stake their tokens with Lido Finance (LDO) will have to wait until May to withdraw as the team needs more time to complete security audits of its V2 upgrade. The news was revealed in a Twitter space hosted by Lido developer Kadmil.eth.

LDO is the dominant liquid staking derivative protocol on Ethereum. Investors have staked more than 5.9 million ETH on Lido. The upcoming V2 upgrade will allow users to withdraw ETH.

Ethereum's Shanghai upgrade this week will allow anyone who has staked ETH by running a validator on the beacon chain to withdraw their staked assets. Many within the community anticipate investors to unstake and offload ETH on the open market, while others are confident that no massive crash will happen.

🙅♀️Binance Refused Justin Sun’s Huobi Offer

According to a Coindesk report, Binance has refused Justin Sun's offer to buy his stake in Huobi. An anonymous source familiar with the situation revealed that Binance refused the offer due to Huobi's rumored ties to China.

Sun originally purchased Huobi in October 2022. Last month, he revealed that Huobi might acquire a license in Hong Kong and launch a new exchange in the jurisdiction under the name ‘Huobi Hong Kong.’

Justin Sun reacted to Coindesk's report by stating that he had not proposed any offer to Changpeng Zhao.

Bonus News:

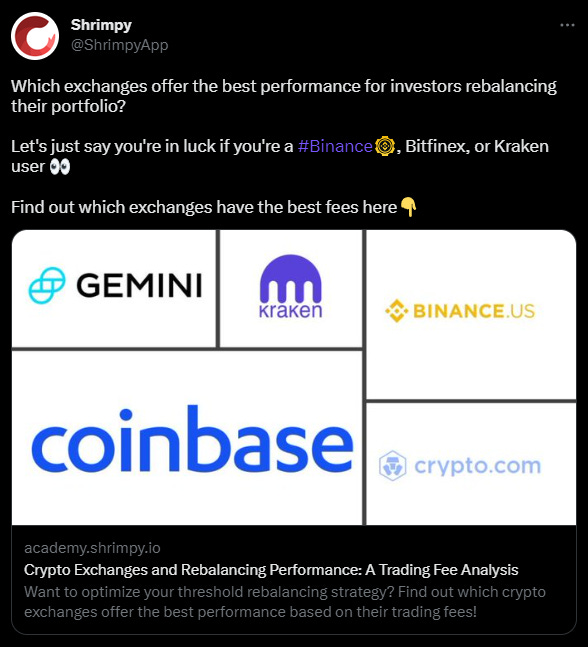

Shrimpy Research: Crypto Exchanges and Rebalancing Performance — A Trading Fee Analysis

Last week's research shows which crypto exchanges bring the best returns and how threshold rebalancing compares to HODL at various tolerance bands and trading fees.

Our latest case study concludes that threshold rebalancing outperforms HODL on all popular cryptocurrency exchanges.

In fact, rebalancing managed to outperform HODL even on the most expensive crypto exchange: Coinbase!

Our best performer was a portfolio utilizing a 15% threshold tolerance band in combination with 0.1% trading fees, which scored 72.93% higher than HODL!

Make sure to read our full case study to see all of our results and conclusions.

Don’t forget to subscribe to our newsletter to keep up with the latest crypto news!